Summer slump is the revenue decline that most publishers observe around July, learn about the factors that cause this decline, and what you can do about it.

It’s that time of the year, again. Just like any other business, seasonality affects publisher revenue also. But why is that? How seriously does it impact their earnings? Is there a way to control it?

If you are an experienced publisher, you probably know seasonality hinders revenue flow. However, publishers can stabilize this situation to minimize damage. First, let’s understand the causes of the seasonality; especially the summer slump that publishers are experiencing right now.

What is the Summer Slump?

The summer slump is a decrease in ad revenue observed during a few months of summer (especially around July). A major cause of the decrease in revenue is decreasing website traffic and ad fill rate around this time.

The severity of the summer slump varies depending on the website’s niche, geographical location, and content type. However, slowdown during summer has become an inevitable truth for all in the ad ecosystem.

What Causes the Slowdown During Summer?

Festive months (the months when Black Friday, Thanksgiving, Christmas, and Easter fall) are when people spend the most. They go online and surf websites looking to find the perfect gifts for their family and friends.

As a result, there is a direct increase in website traffic and user engagement for most publishers. This is why they see the highest earnings in Q2 and Q4.

However, as a new year starts, businesses are likely to spend less and save their budgets for upcoming events or internal expenses. This is one of the reasons why the starting of the year January faces the biggest drop causing the great revenue drop during the start of month.

Similarly, at the end of Q2 and start of Q3, publishers see a significant drop in ad revenue. This is again caused by the change in the quarter and the fact that there are no big festivals around. Because of these factors, summer becomes a vortex of unpredictable and unstable earning for publishers.

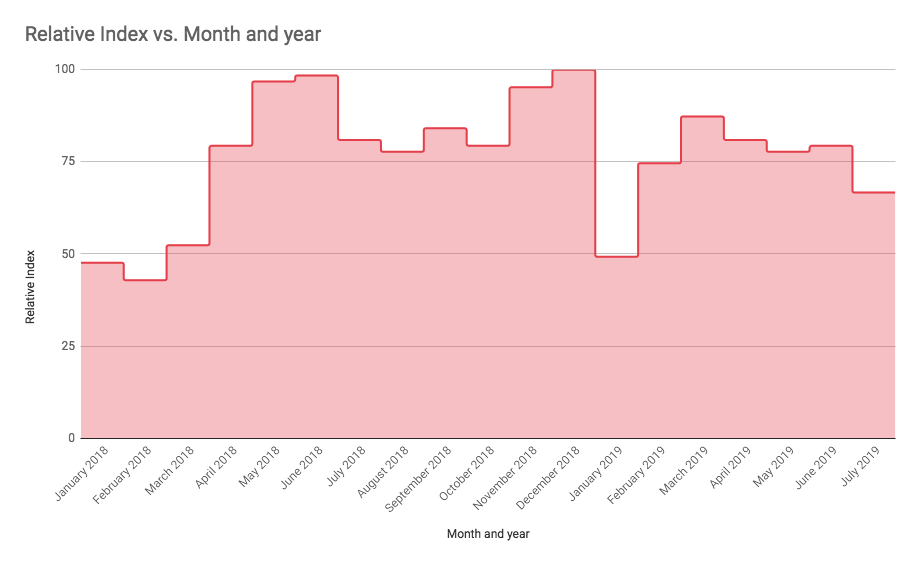

Take a look at these revenue stats from last year:

The above graph shows a significant slope in the months of June and July.

We calculated this by evaluating the monthly eCPM of publishers in our network based on data collected from almost 3 billion ad impressions.

From the data, we derived a relative index, which is the ratio of average eCPM of each month (January to December) divided by maximum eCPM for all twelve months times 100.

Relative index = (avg eCPM/max eCPM)*100

Using the relative index metric, you can see the change in monthly earnings of publishers with respect to their maximum earnings to get a better idea about the slowdown around summer.

How Long Does the Slowdown Last?

It depends on market trends and publishers efforts. As per the above chart, you can see the revenue starts increasing with the beginning of August. However, some publishers can see stable earnings before August as well, others may have to wait further.

Simply put, once the market starts to stabilize, publishers can take a sigh of relief. As the third quarter kicks off, publishers see better traffic and CPMs. As the effects of seasonality start to wear out, the ad revenues increase and stabilize. And then the Q4 arrives with the highest returns of the year.

Damage Control Tips for Publishers

The building blocks of ad revenue are: Traffic, fill rate, and CPM.

Starting with the traffic. As mentioned above, publishers notice a significant decrease in impressions during the month of June and July. In such cases, it’s better to tap into your niche audience. Send some of your most engaging content to your email list. Also during this time, don’t forget to keep up with best practices to stabilize and increase site traffic.

Next, fill rate, the ratio of the number of ads served and the number of ad requests generated by a site. Suppose a website generates 1000 ad requests an hour and gets 900 ad creatives, then the fill rate will be 90%. Publishers can generate all the ad requests they want, but fill rate is decided by demand. Low bids during some months may lead to a decreased fill rates. You can learn more about fill rate here.

Finally, CPM. If advertisers are spending less, publishers earnings will decline too. The same is noticeable in the months of summer when advertisers decrease the flow of money from their side, sucking the money out of the ad tech ecosystem and affecting publisher earnings. The first step to optimizing CPM is understanding the factors that affect it. However, there is pretty much nothing that publishers can do beyond a point if the advertisers decide to cap their ad spend.

What Else Can Publishers Do?

- Keep an eye on SEO:

If your site ranks well on search engines, then you will probably get healthy traffic throughout the year. Therefore, working on the site’s search ranking pays off, even during slower months. This includes not just keyword optimization, but also tactics to improve user experience.

- Revamp old content:

Updated content boosts search rankings and increases user engagement. If you have some well-performing post from previous years that are losing their ranks, work on updating them. This tactic works very well for most publishers and can prove beneficial during the slump.

- Optimize page load time and ad viewability:

Faster sites have better fill rates. And in times when fill rate is low, working to improve page latency can counterbalance the damage. While reducing spend, advertisers check viewability scores and prefer to invest in high-value inventory. Hence, reduced load time and improved viewability can be useful during slower months.

- Design content for users:

Pay attention to your users. Seasonality is inevitable, but it also ends. However, your content will be required all around the year. Hence, prioritize your users and create content that is valuable and will continue to remain so in the times to come, regardless of what month it is.

Shubham is a digital marketer with rich experience working in the advertisement technology industry. He has vast experience in the programmatic industry, driving business strategy and scaling functions including but not limited to growth and marketing, Operations, process optimization, and Sales.