Major ad tech challenges and trends summarized in a single article. Discover innovations and challenges to enrich your programmatic media buying in 2023.

The programmatic advertising market is rapidly transforming under the influence of the market changes introduced during 2020-2022: privacy regulations, restrictions in measurement and attribution, transition to new technologies, and different post-COVID content consumption realities.

Also Read: Programmatic Advertising – A Quick Guide For Publishers

As of now, third-party tracking cookies are living their last days; regulatory requirements are getting tougher, and new initiatives are emerging to strengthen the protection of personal data. However, new emerging technologies like CTV and DOOH are also strengthening, which gives new hope to publishers who want to reap the benefits of the new monetization opportunities.

With numerous challenges and opportunities waiting for publishers in 2023, they have a chance to demonstrate to market participants their ability to increase the efficiency and profitability of advertising and improve their own incomes as a result.

Ad Tech Challenges and Trends that Publishers Can Face in 2023

The advent of the RTB era made it possible to introduce new models of interaction between publishers and advertisers and automate the most routine tasks, including campaign management, setup, ad placing, transaction processing, and many other different tasks.

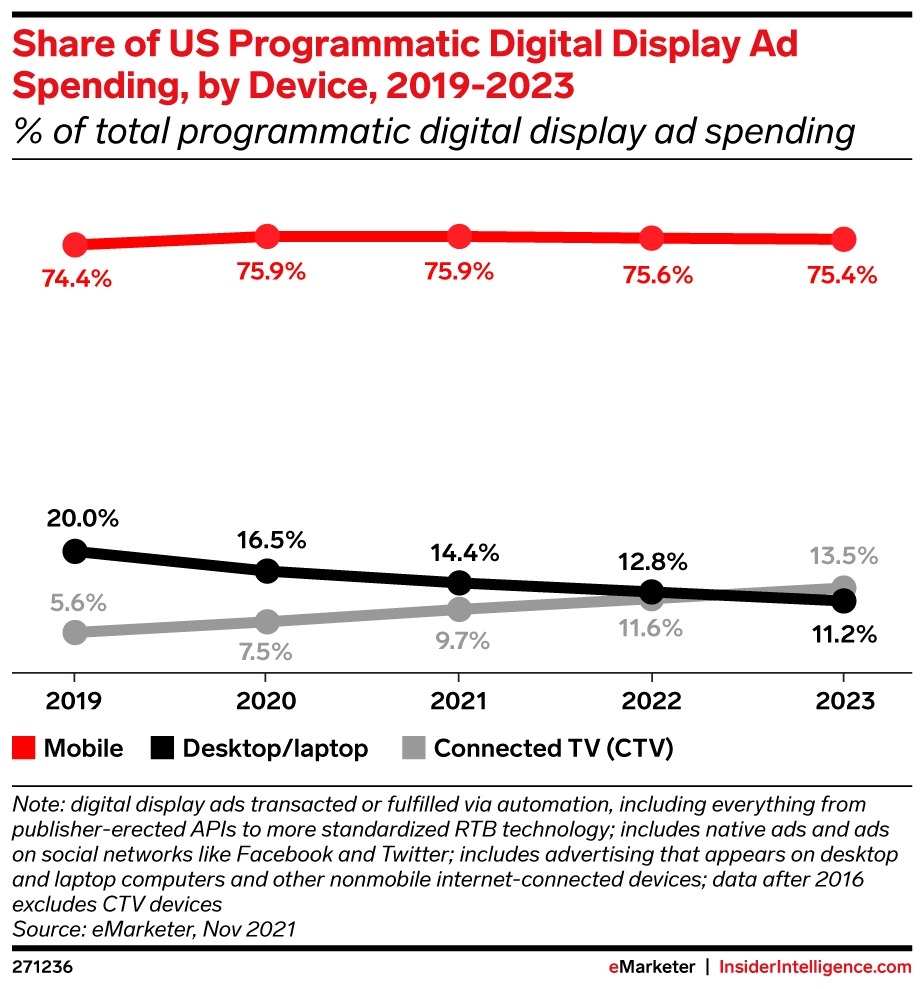

For this reason, programmatic has become one of the most popular ways of selling ad inventory. It is expected that by the end of 2023, total programmatic display ad spending in the U.S. will reach 141.96 billion dollars.

However, modern automated ad buying and selling are not perfect yet, as programmatic has several issues to resolve in 2023, and the most important of them is auction duplication.

Auction Duplication and SPO as a Solution

Today, when the share of programmatic in digital advertising budgets is up to 80%, and the publisher often works with 10+ exchanges, it has become much more difficult to understand how, where and at what price the inventory is sold. As a result, the same od impression can be sold by various vendors for different prices (as resellers have different commissions) and at diverse auctions.

The role of the SSP vendor here is to understand that one source should not try to monetize the same impressions simultaneously through a direct channel to the DSP and through other exchange networks. The SSP vendor must select a preferred channel for each purchasing source and offer DSP impressions only through that selected channel to avoid a bidding duplication problem.

However, the problem is deeper than this and requires the attention of all ecosystem participants and a more complex approach to address this issue. For this reason, many ad tech vendors are currently leveraging SPO (supply path optimization).

Supply path optimization (or optimization of the inventory purchase path) is an algorithm that makes it possible to assess, analyze and optimize the purchase path of digital inventory. This assessment includes not only direct partners but also all intermediaries and resellers that take part in media trading.

Worth to point out that different vendors offer various optimization mechanisms, but in a nutshell, SPO always boils down to the following steps:

- Running the audit of the supply path and understanding how many and what kind of entities are included in it;

- Assessing each SSP vendor according to the chosen criteria and analyzing who they sell inventory to;

- After a thorough assessment of the vendors, the selection and consolidation of partners should follow (based on the most optimized ways of inventory trading).

Publishers should consider SPO as an opportunity to inform demand partners about their preferred purchasing channels, that is, channels that allow them to recoup the costs of working media resources and save ad budgets while getting impressions only through the most optimal paths.

Big publishers that have their own programmatic platforms can make SPO a part of their strategy; however, smaller publishers will need to rely more on finding the right partners and choosing a suitable supply-side platform.

Also Read: Top 15 Supply Side Platforms (SSP) For Publishers in 2022

There are additional tools in programmatic that allow you to make the supply chain completely transparent, authorized, and fraud-free (like ads.txt, seller.json, and supply chain object). With this, worth to mention that a certain share of media buyers is already giving preference to those publishers who implemented those standards, and for sure, for this reason, it will be a good practice to adopt in 2023.

Shifting to Contextual Ads and First-Party Data

As mobile app identifiers come to pass and changes in cookie policies tighten, there are more and more blind spots and inaccuracies that limit the opportunities to measure and analyze ad campaigns.

The fragmentation of user attention and the ‘walled gardens’ further complicate the attribution funnel analysis process. Tightening privacy regulations like GDPR, CCPA, COPPA, and other global privacy frameworks also oblige publishers to obtain user consent prior to data collection.

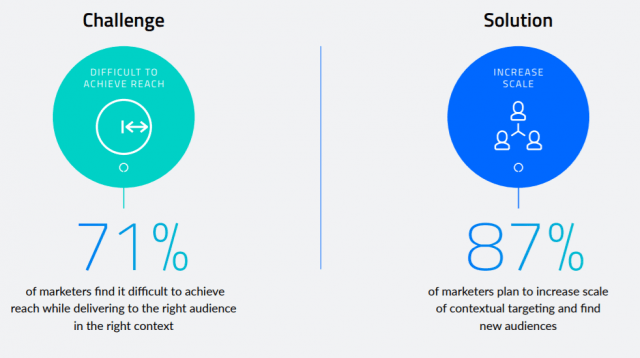

For this reason, many advertisers will most likely distribute more of their ad budgets toward contextual advertising in 2023. Leverages for precise mobile attribution are still being developed to replace the IDFA, but one thing is for sure — the new solution will be oriented towards cohorts or some app/content signals rather than towards identifying digital traces of particular users.

In this regard, models that use the mosaic data principle are likely to become widespread. They will use data from different sources, and such a solution will unify the presentation of results. The significance of the attention economy is also predicted to grow further as publishers will focus more on retaining users in apps and engaging them enough to receive consent for data collection.

As for the further development of data approaches, it’s worth pointing out that more and more attention will be paid to first-party data since the share of third-party (purchased data) is getting shrunk. For this reason, publishers who manage to encourage users to share their data will also get the chance for successful data monetization.

Rise of the CTV, Video Ads, and DOOH Advertising

In the new, privacy-friendly realities, marketers will be more focused on unlocking insights, activating data, using powerful creatives, and reaching the target audience through innovative media channels.

We are moving towards a much deeper synthesis between data and creatives, and for this reason, even such previously traditional mediums as TV and outdoor advertising are turning into digitalized and targeted advertising mediums.

As the pandemic hit the world, content consumption habits changed drastically — people started spending more time in front of their SmartTVs and personal gadgets. Digital video, as the most common ad format on CTV, is expected to grow 26% higher by the end of 2022 (compared to 2021). Meanwhile, CTV spending will climb 39% higher when compared to the previous year.

However, for the continued growth and development of programmatic CTV, the industry has yet to overcome several barriers, including inventory fragmentation development of better measurement capabilities on CTV platforms. Accordingly, in 2023 we expect that solutions like this will appear to make inventory buying on CTV more efficient and even more precise in terms of targeting.

Worth pointing out that this progress will be heavily influenced by CTV publishers and their readiness to adopt clear standards that would enable sharing of data about served impressions and placements. Along with this, it is important for CTV publishers to ally with third-party verification partners to make sure that the content that is sold is thoroughly validated.

The same applies to DOOH advertising, as its capabilities are still maturing and thus require a more robust infrastructure for more precise targeting. Still, even with the existing capacities of DOOH, it becomes possible to fuel the outdoor digital screens and billboards with data necessary for sophisticated targeting.

This way, for instance, an advertiser can display ads according to certain conditions (that will depend on data input) e.g. current weather conditions, time of the day, geolocation, etc.

The ad spending for DOOH advertising will reach $3.84 billion in 2022-2023, signifying a great opportunity for DOOH publishers to monetize their inventory in the future.

When the majority of DOOH advertising is done programmatically, the routine tasks of media planning and buying will be automated, meaning that advertisers will automatically bid on publishers’ ad impressions in real-time auctions.

DOOH publishers, meanwhile, will be able to set up the floor prices for inventory and transact with the same efficiency as they now have with display campaigns.

To Wrap it Up

Trends that have been formed during the last couple of years will be surely defining for the advertising landscape in 2023. While publishers are bracing themselves for many challenges and the aftermath of privacy-related restrictions, they can also find the opportunities that arise from the new advertising mediums that came to the surface.

Moreover, with new tools, mechanisms, and algorithms of supply path optimization, publishers will make this ecosystem more transparent, reliable, and fraud-free.

Grow your revenue up to 40% with us. Set up a free demo.

FAQs

Advertising technology includes a variety of tools and technology, such as demand-side platforms, supply-side platforms, agency trading desks, ad servers, and ad networks, which help advertisers serve relevant ads to relevant audiences.

Global Ad Tech Software Market was valued at USD 16.27 Billion in 2018 and is expected to reach USD 29.85 Billion by 2026, growing at a CAGR of 7.9%.

Together they form a loop of ad supply and demand that generates revenue – this is achieved through collecting and processing information on the user activity on a particular platform.

Shubham is a digital marketer with rich experience working in the advertisement technology industry. He has vast experience in the programmatic industry, driving business strategy and scaling functions including but not limited to growth and marketing, Operations, process optimization, and Sales.

![CTV vs OTT Advertising: Which one is Right Pick for Publishers? + [6 Bonus Strategies] Ott vs Ctv](https://www.adpushup.com/blog/wp-content/uploads/2023/02/Featured-Image-270x180.png)